Korean Cultural Artifacts Fail to Sell at Auction Amid Growing Market Tensions

The world watched this week as two important Korean cultural artifacts headed to auction for the first time. Earlier this month, the Kansong Art Museum in Seoul announced plans to deaccession two ancient works of art from its collection. It hoped that revenues from their sale would provide some much-needed cash. Yet the two cultural artifacts failed to draw any bids, let alone achieve a record price on January 27, 2022. Even though the objects could not legally leave South Korea, The Korea Herald reports that the sale was controversial from the start.

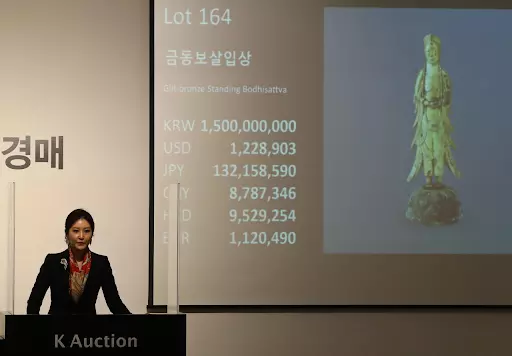

The offered artifacts are known as the Portable Shrine of Gilt-Bronze Buddha Triad and the Gilt-Bronze Standing Buddha Triad with Inscription of Gyemi Year. The former dates back to the 11th or 12th century, and it had a presale estimate of KRW 28 billion to ₩40 billion (USD 23.6 million – $33.7 million). The latter Standing Buddha Triad may have been carried by 6th-century Buddhist monks for protection. It had an estimate of ₩32 billion to ₩45 billion ($26.6 million – $37.3 million). The relics will return to the Kansong Art and Culture Foundation after failing to sell at auction.

Both Korean cultural artifacts are “national treasures,” two of just 350 state-recognized items or places with that classification. Most other national treasures are heritage sites. South Korean law prevents the sale of designated national treasures outside of the country. However, they may be bought and sold within its borders with prior notification to the Cultural Heritage Administration.

Although the controversial items were legally eligible for sale, the response from K Auction’s bidders was lackluster. The two relics were nestled in the company’s January auction of Modern, contemporary, and traditional Korean art. Seeing no bids, the auctioneer quickly moved ahead to other lots. Smart Times reports that two decentralized autonomous organizations (DAOs) organized earlier this month and attempted to purchase the objects. However, they failed to raise the necessary funds in time for the auction. This marks the first time that DAOs in Korea have specifically formed to participate in an auction.

This is not the first time Kansong Art Museum has turned to the secondary market to alleviate its financial stress. Founded by philanthropist Jeon Hyung-pil in 1938, Kansong Art Museum is Korea’s oldest private art museum. Its founder hoped to protect important Korean cultural artifacts from export during the period of Japanese occupation (1910 – 1945). The Museum has been closed due to excessive debts since 2014. The COVID-19 pandemic and a hefty inheritance tax bill have further weakened its finances. Needing funding for a major renovation and temporary opening, the Museum has taken the controversial path of deaccessioning.

Kansong Art Museum attempted to sell two other Korean cultural artifacts with K Auction in May of 2020. No bids came for the state-designated treasures. The National Museum of Korea eventually purchased the works for an undisclosed amount. (A curator at the museum later confirmed that the prices fit into the institution’s ₩4 billion yearly budget for acquisitions.) Heads are again turning toward the National Museum of Korea after the most recent auction flop. It is uncertain if the Museum can afford the artifacts with their current price tags.

This news comes amid growing tensions in the Korean art market. South Korea’s two largest auction houses, Seoul Auction and K Auction, enjoyed unprecedented growth in recent years. According to the Artnet Price Database, 2021 sales of fine art at Seoul Auction and K Auction increased more than 300% from 2020. The houses together made approximately USD 250 million last year. Additionally, the companies have hosted more events than usual and are increasingly seeking works from younger artists.

The Galleries Association of Korea reports that the auction houses violated an informal agreement with the primary market players and are cutting galleries out of the picture. Many in the industry fear that the auction houses’ actions harm the long-term careers of young artists. Inflated prices for their work and inhibited artistic growth are two known consequences. In response, the Association hosted its own auction of fine art by mostly young artists on January 26, 2022.

“It is a message that we need to practice good manners as key art market players,” the Association’s chairman, Hwang Dal-sung, told The Korea Herald. “We are aware of some inappropriate actions taken by the auction houses, such as contacting artists to work directly with auction houses, undermining the role of galleries.”

Hosting gallery-led auctions is a temporary move, says the Association, and the top auction houses have yet to respond formally. However, as the recent failed sale of Korean cultural artifacts shows, the current market dynamics are far from static. The public outcry over the auction turned an international spotlight on the existing tensions. And as Seoul continues to take its place as a global art hub, it’s likely that the power struggle is far from over.

Auction Daily regularly covers art market news. Check out our survey of 2021 auction results from across the industry.