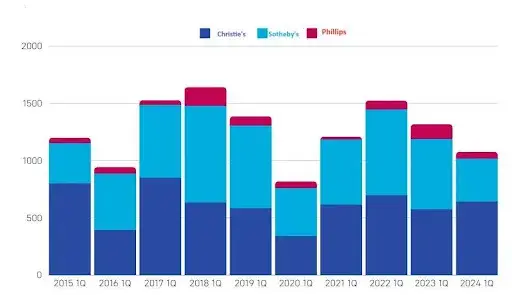

Sales at World’s Top Three Auction Houses Fell 18.3% in 2024’s First Quarter

In 2024’s first quarter, sales at the three major global auction houses (Christie’s, Sotheby’s, and Phillips) fell 18.3% from the same period last year to USD 1.08 billion. The figure is also down 29.4% compared to 2022, a decrease attributed to falling sales in New York and London. However, Christie’s sales increased 11.2% in the first quarter compared to the same period last year thanks to a sharp increase in Paris sales.

According to the “Art Market Report 1Q 2024” released by Korea Art Authentication & Appraisal Inc. (KAAAI), the global auction market is steadily establishing online trading methods amid a decrease in the number of auctions and the number of works compared to the same period last year.

The number of auctions was 151 in 2024’s first quarter, down from 166 in 2023, and the total number of lots sold was 17,905, down from 19,846 in 2023. Despite the easing of the pandemic, the decline in offline auctions (down 16.6 percent) was noticeable. The average item price at auction was $60,113, the lowest level since 2017, down from $66,350 last year.

The online sales of the three major auction houses amounted to about $142 million in 2024’s first quarter, down 3.4% from about $147 million in the same period last year, making no significant difference. In particular, the number of artworks sold through online-only channels accounted for 59.8% of all auctions in the first quarter, up from 56.6% in the same period last year. In terms of total auction sales, online sales accounted for 13.2% (compared to 11.2% last year). “We can confirm that online transaction methods are stably established,” KAAAI said.

By region, sales in New York and London fell, but Paris saw a notable increase in sales ($117 million). This was attributed to the Barbier-Mueller Collection, which Christie’s held in Paris in March. The auction of the collection represented 62.3% ($73 million) of the total sales achieved in the first quarter of the year in Paris. On the other hand, sales in New York and London fell 23.5% and 16.7%, respectively, from the same period last year. “The biggest characteristic of the art market’s sales structure is that high-quality collections can achieve an absolute share of total sales when they flow into the market,” KAAAI said.

By sector, sales of post-war and contemporary art plunged about 48.3% from last year, leading to an overall decline in auction sales. Printmaking (including prints and editions) failed to continue last year’s sales surge and fell 8.9% from the same period last year. Despite a 9.9% increase in the number of auction entries, the decline in sales means that the price of prints was traded at a lower level. KAAAI said, “The light-priced works favored by the newly emerged collectors also reflected the overall economy.”

At the same time, the Korean auction market recovered slightly in 2024’s first quarter compared to the same period in 2023. However, the primary and distribution markets have shrunk to the extent that there was little movement in trading. Korea’s major auction houses (K Auction, Seoul Auction, and My Art Auction) sold about $21.6 million in total through seven auctions. This figure rose about 6.81% year-on-year. The number of artworks sold was 500, up 12.10% from the same period last year, and the winning bid rate was 65.19%, down 2.18 percentage points.

A total of two works were sold for over $730,000. The highest price was Kim Whan-ki‘s 3-V-71 #203 (1971), which recorded a successful bid of about $3.67 million, followed by independence activist Ahn Jung-geun‘s handwriting, which sold for about $1 million.

However, the atmosphere of recovery is also slowing down in the second quarter. Works by painters Lee Ufan and Henri Matisse recently failed at auction, and two Kim Whan-ki artworks were withdrawn. “It is a time of chaos when falling prices of artworks are becoming a reality,” KAAAI said. “As the level of economic tightening, including high interest rates, high inflation, and uncertain prospects, is expected to be maintained for a while, the art market is also expected to remain on the lookout.”