Korea News: Will the Korean Art Market Run Smoothly After Frieze Seoul?

Frieze Seoul, which was recently held in Korea for four days, has heated up with an estimated transaction amount of around USD 435 million (KRW 600 billion), but it was pointed out that optimism in the Korean art market in the second half of the year can be dangerous. According to the Analysis Report on the Domestic and Foreign Art Market in the First Half, published by the Korea Art Authentication & Appraisal Research Center (KAAARC), the Korean art market has taken a sudden break without a safety device.

In the first half of the year, the global art markets enjoyed a boom, achieving record numbers based on auctions. Despite the decline in global economies due to the war in Ukraine and economic inflation, the overseas auction market reached a total of $2.52 billion in the post-war and contemporary art sectors in the first half of this year. This is an increase of 18.7% compared to last year. On top of that, the Impressionism and Modern painting sectors jumped 56.8% from last year to $2.41 billion. Looking at the auction market, large collection auctions from the likes of Anne Bass and Thomas and Doris Ammann played a big role. KAAARC analyzed that the activation of online auction platforms also led to an increase in sales of works, along with transaction volume.

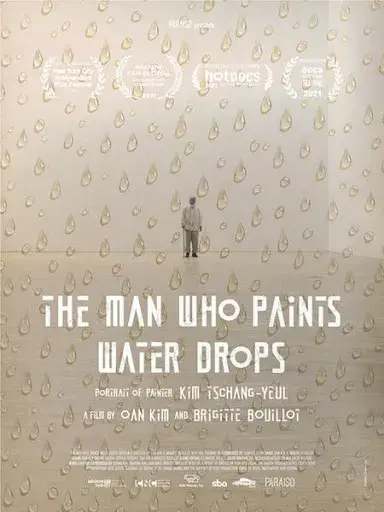

KAAARC predicted a decline in the Korean auction market with an analysis that the auction season in July showed the end of the boom. As the basis for this analysis, the total number of successful bids and the decline in the successful bid rate of Kim Tschang-yeul (1929 – 2021), who is considered a monochromatic master, were suggested. Shortly after the death of artist Kim Tschang-yeul last year, his works received great attention and auction prices rose. Several items were submitted at last year’s auction, but they did not last a year. The total winning bid for Kim Tschang-yeul’s work exceeded USD 4.4 million (KRW 6 billion) in the second quarter of last year, but it fell to the USD 800,000 range (KRW 1 billion range) in the second quarter of this year.

KAAARC said, “By intensively auctioning several major artists’ works and creating price increase figures, funds were concentrated on artists whose auction prices would rise. The price bubble was created faster than ever.” KAAARC added, “The boom is over and the works that have risen in price are starting to be reevaluated with strict standards.”

KAAARC cautiously predicted the trajectory of the Korean art market: “On average, the boom cycle in the art market is ten years. we cannot guarantee an opportunity to sell collections at a reasonable price again because the investment portfolio may change when the boom comes again.”

It remains to be seen how the hot heat confirmed from Frieze Seoul will flow over the Korean art market. Frieze Seoul, the largest art fair held in the city, was held with the Korean International Art Fair (KIAF) by the Galleries Association of Korea. More than 70,000 people (excluding duplicate visits) participated in these art fairs. Frieze hit the jackpot on its first visit to Seoul, and Kiaf also achieved its best performance ever, with its transaction volume estimated at more than USD 50 million (KRW 70 billion range) this year. The world’s leading galleries participated in these art fairs, and there have been a series of cases in which they are seeking to enter Korea.

However, the economic situation at home and abroad is alarming. Amid considerable economic slowdown pressure such as interest rate hikes and falling stock prices in the face of global inflation, the Korean art market is also unlikely to be able to completely escape the trend of the international economy. Another survey also showed a gloomy outlook surrounding the art market in the future. In a recent survey conducted by ArtTactic, a British art market research company, 40 percent of global collectors said that “the price of new artists’ works will fall in the future.”