What Made the Macklowe Collection So Successful at Auction?

The second round of modern and contemporary masterpieces from the collection of Harry and Linda Macklowe just smashed records at Sotheby’s. This second installment brought in USD 246.1 million. Combined with the results from the first sale last November ($676.1 million), the Macklowe Collection is now worth a total of $922 million. This figure pushes past the record for a single-owner private collection sold at auction, previously held by the Rockefeller estate (not including inflation).

Which factors made the Macklowe Collection such a resounding auction success?

“Art in Its Highest Form”: Choice of Works

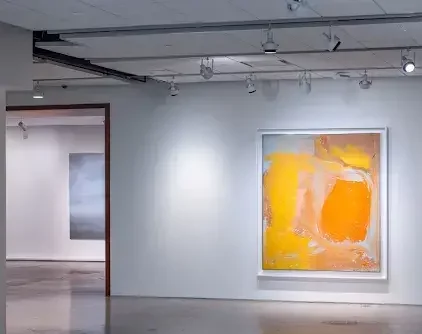

“The Macklowe Collection tells the story of art in its highest form, with the utmost precision and clarity. Every artist here is represented at a moment of profound creativity,” Brooke Lampley, Sotheby’s Chairman and Worldwide Head of Sales for Global Fine Art, said before the recent sale.

Critics and art market observers have noted that the careful curation of the Macklowe Collection was a major factor of its success at auction. The Macklowes intentionally purchased artworks from specific moments of famous artists’ careers. These were often the most productive or most developed periods; Mark Rothko between the Seagram Murals of the 1950s and the de Menil Chapel of the 1960s, for example. Many of the offered artworks were acquired soon after their creation, thus removing them from the market for decades. During that period, these artworks traveled to museums and exhibitions. Each piece acquired an extensive history in the public eye while remaining in private hands. Budding fame followed in their wake.

“Good Works Are Hard to Find”: A Blue-Chip Market Boom

The latest UBS Art Basel Report from economist Clare McAndrew confirms what many have already observed: reports of the art market’s death were greatly exaggerated. In fact, the highest slice of the industry has bounced back from pandemic-related losses in remarkable time. A flood of blue-chip artworks helped propel the largest auction houses to new heights. Yet these exclusive works still stand head and shoulders above an oversaturated art market.

Enter the Macklowe Collection. The couple joined the likes of Anne Bass and Ann and Gordon Getty in releasing their treasure troves to the market this year. High net worth (HNW) collectors have taken the opportunity to snatch up masterpieces at unprecedented rates.

“The art market feels very close to the spare parts market— good works are hard to find and very expensive,” Loic Gouzer, a former Christie’s specialist, told The New York Times in light of the Macklowe Collection’s major auction success.

“The Greatest Payback”: World Tour and Media Blitz

Before appearing at auction, Sotheby’s took items from the Macklowe Collection on a whirlwind world tour. They graced exhibition walls in London, Palm Beach, Shanghai, Taipei, Tokyo, and Hong Kong before crossing the block. Sotheby’s worked to drum up anticipation for the Macklowe Collection months in advance.

Detailed media coverage of the Macklowes’ contentious divorce and resulting court-ordered auction consignment also helped. Harry Macklowe’s hand can be seen in many of Manhattan’s skyscrapers, and his $2 billion divorce from Linda (Burg) Macklowe has fueled tabloids since 2016. The record-breaking sale of their art collection is a fitting conclusion to the couple’s joint history.

“I never thought I’d see a sale of the Macklowe collection,” Harry Macklowe told the press after the most recent sale. “I’m thrilled by it. Not by the economics, but by the quality being recognized by collectors. Everybody endorsing the choices we made over the last 65 years, that was the greatest payback.”

Find previous coverage of the Macklowe Collection on Auction Daily.