Sotheby’s Metaverse: First Auction on Dedicated NFT Platform Bags $18.7 Million

Seven months after Beeple’s massive collection of non-fungible tokens (NFTs) made history at Christie’s, competitor Sotheby’s has taken another aggressive step into the digital art world. The company has officially launched an in-house NFT platform: Sotheby’s Metaverse. Sotheby’s is the first major auction company to directly rival dedicated crypto marketplaces such as OpenSea. The first test for Sotheby’s Metaverse was an auction of 53 NFTs from a small group of renowned collectors. The timed Natively Digital 1.2 sale closed for bidding on October 26th, 2021. It brought in approximately USD 18.7 million.

The first auction on Sotheby’s Metaverse packed ample star power. An early NFT from Pak was among the top lots. The mysterious artist launched this piece on SuperRare in 2020. It reimagines the iconic Rubik’s Cube as a metallic fantasy structure that defies the original puzzle’s logic. Pak’s Rubik’s Lure sold for $1.1 million. A CryptoPunk was also a leading lot. This particularly rare Punk is one of just 3,840 female avatars created by Larva Labs. She is one of 54 wearing a tiara accessory. The NFT sold for $867,000. Other works from iconic crypto creators attracted the highest prices: a Bored Ape from Yuga Labs reached $3.4 million, and a rare Pepe NFT achieved the highest result after selling for $3.65 million.

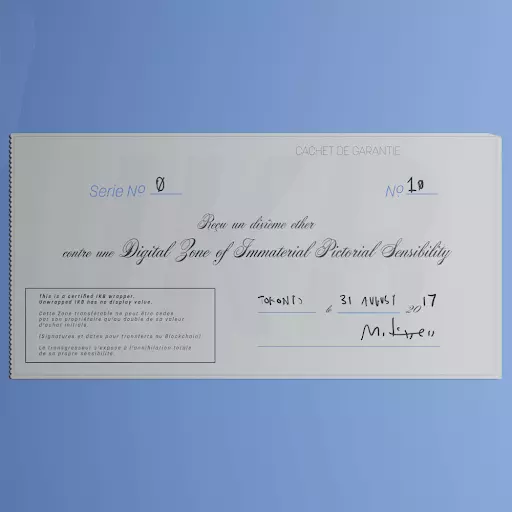

Notable lots included Mitchell F. Chan’s Digital Zone of Immaterial Pictorial Sensibility (Series 0, Edition 10). Minted in 2017, this NFT is practically vintage in crypto terms. It predates the invention of the ERC-721 standard and references Yves Klein’s 1959 Zones of Immaterial Pictorial Sensibility series. Klein interrogated the value of art and its materiality. Chan revived those ideas to discuss the very nature of digital art ownership. The work sold for $1.5 million. NFTs by LIŔONA, Dmitri Cherniak, Jacky Tsai, Steve Aoki, and Gal Yosef also saw strong results.

The Natively Digital 1.2 auction was the result of broad collaborations in the art world. Sotheby’s worked with famous crypto collectors such as Pranksy, 888, j1mmy.eth, and, unexpectedly, American socialite Paris Hilton to build the catalog. Time magazine also contributed a typographical artwork consisting of cover lines from the 20th and 21st centuries. Collectors heard directly from the collectors and curators behind the auction on the new Sotheby’s Metaverse Twitter (@Sothebysverse) and dedicated Discord server.

This timed auction followed several successful digital art sales at Sotheby’s. The company jumped into the growing market in April of 2021. The Fungible Collection of NFTs brought in $16.8 million over three days. Two months later, Sotheby’s offered the first edition of its Natively Digital series. The auction totaled $17.1 million after a flurry of last-minute bidding.

To bid with Sotheby’s Metaverse, collectors had to first choose a pseudonymous screen name and select a randomized pixel profile photo designed by Pak. While the structure of the Metaverse resembles other NFT buying platforms, Sotheby’s worked to make the site more accessible to traditional collectors. Current bids appeared in standard US dollars as opposed to Ethereum (ETH). Sotheby’s did not require a cryptocurrency wallet to bid, though winners needed a valid ETH address to support their purchased NFTs. Additionally, the first Sotheby’s Metaverse auction accepted traditional payment methods in addition to cryptocurrency.

Notably, bidding on Sotheby’s Metaverse occurred off-chain. This means that an NFT’s metadata is stored separately from its smart contract on a blockchain. NFTs may be stored off-chain due to the storage limitations of the blockchain or, in Sotheby’s case, to maintain established company practices.

The auction house has big plans for the new Sotheby’s Metaverse platform. In the future, collectors can expect NFTs at Sotheby’s to include contemporary art, fashion, sports, science, and beyond. This may help Sotheby’s compete against NFT marketplaces such as OpenSea, SuperRare, and Nifty Gateway. These platforms already have loyal user bases, accreditation, and visibility within the crypto community. Brick-and-mortar businesses such as Sotheby’s will have to match their art expertise with a new level of digital know-how. Company leaders are prepared to take that next step.

“When Sotheby’s first entered the world of NFTs earlier this year, it was immediately clear that we had so far only scratched the surface of the potential of this new medium, and of NFTs,” said Sebastian Fahey, the executive lead for Sotheby’s Metaverse. “We are in a unique position at Sotheby’s to apply our expertise and curation to the burgeoning world of art for the digitally native generation.”

Visit Sotheby’s Metaverse for the complete auction results and more information.