K Auction

23 Eonju-ro 172-gil, Gangnam-gu, Korea

223-479-8888

About Auction House

K Auction is an art auction company that offers modern and contemporary Korean art.Auction Previews & News

1 Results-

Auction Industry

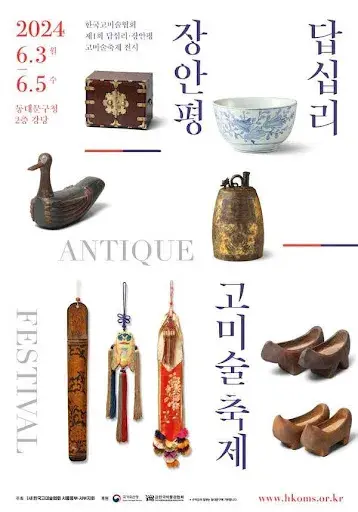

Auction Industry[미술축제] 미래가치 담은 옛 유물 한자리에… 제1회 고미술축제 6월 개최

한국 문화유산에 대한 관심을 높이기 위한 고미술축제가 처음으로 열린다. 한국고미술협회(회장 김경수)는 6월 3일부터 5일까지 서울 동대문구청에서 고미술업체들과 함께 ‘제1회 장안평&답십리 고미술축제’를 개최한다. 이 축제는 K-Pop, K-콘텐츠 등 K-컬처에 대한 관심이 커지면서 이들의 근간이자 영감을 준 문화유산을 알리기 위한 취지로 기획됐다. 특히 지난 5월 17일부로 국가유산기본법이 시행돼 문화재(cultural properties)라는 용어 대신 문화유산(cultural heritage)으로 바뀌는 등 국가유산 체제 전환에 맞춰서 열린다. 제1회 장안평&답십리 고미술축제 포스터 (제공. 한국고미술협회) 이 축제에 전시되는 문화유산은 화려하고 고고한 옛 그림이나 백자, 청자만을 가리키는 것이 아니다. 과거 일상에서 쓰이던 소박한 화로, 소반, 떡살과 같이 오랜 세월과 생활 흔적이 담긴 물품 모두를 아우른다. 이런 다양한 문화유산을 시민과 향유하고자 행사는 마련됐다. 함께하는 고미술업체들은 답십리와 장안평에 위치한 고미술상가에 입주해 있다. 이 고미술상가는 1980년대 초에 시작해 한국 최대 규모로 고미술 작품 거래가 오가고 있다. 이 상가에는 현재 100여 개 상점이 입점해 있다. 도자기, 고서화, 전적, 목기, 민속품, 석물 및 기타 공예품 등 약 7만여 점 문화유산을 만날 수 있다. 오래된 소품 등 다양한 골동품이 있으며, 세상에 알려지지 않았던 뜻밖의 명품이 발견되기도 한다. 다만 오랜 시간 출처 등이 모호해진 고미술 작품의 진위 여부를 둘러싼 갈등이나 논쟁이 일어나는 경우도 상존한다. 이에 6월 5일에는 유물 가치를 알아볼 수 있는 ‘무료 감정 이벤트’가 마련된다. 유명 TV프로그램 <TV쇼 진품명품>에 출연한 감정위원들이 감정 평가를 할 예정이다. 장안평 고미술상가 전경 Ⓒ옥션데일리 김경수 한국고미술협회장은 “기존 재화적 성격이 강했던 ‘문화재’에서 과거와 미래를 잇는 ‘문화유산’으로 명칭이 확장 변경되는 시기에 열리는 첫 전시회인 만큼 차세대에 더욱 가치 있게 전할 수 있는 예비문화유산 발굴에 노력하겠다”며 “풍부한 미래가치를 품은 답십리와 장안평 고미술상가의 새로운 매력을 발견하기를 희망한다”고 말했다. 1971년에 설립된 한국고미술협회는 문화유산 보존과 계승, 활용에 뜻을 두고 전국 13개 지회에 정회원 450여 명이 활동하는 단체다.

-

Auction Industry

Auction IndustryKorea’s First Ancient Art Festival Will Be Held in June

This June, an ancient art festival will be held for the first time in Korea to raise interest in Korean cultural heritage. 1st Janganpyeong & Dapsimni Ancient Art Festival Poster. Image courtesy of KAA. The Korea Association of Antiquities (KAA) will hold the first Janganpyeong & Dapsimni Ancient Art Festival at Dongdaemun-gu Office in Seoul from June 3 to 5, 2024. The festival is designed to promote cultural heritage, which is the foundation and inspiration of K-culture, such as K-Pop and K-Content, as interest in K-culture grows. This event will be held in line with the transformation of the national heritage system, such as changing to the term “cultural heritage” instead of “cultural properties.” The cultural heritage displayed in this festival does not only refer to colorful and noble old paintings, white porcelains, and celadon. It encompasses all items containing traces of years and life, such as simple furnaces, small dining tables, and rice cake stamps used in everyday life in the past. This ancient art festival is prepared to share these cultural heritages with citizens. A view of Janganpyeong Ancient Art Shopping Center. ⓒ Auction Daily. Ancient art companies participating in Korea’s first ancient art festival are located in the ancient art shopping centers located in Dapsimnri and Janganpyeong. This ancient art shopping center began in the early 1980s and is the largest in Korea, with trading of ancient artworks. Currently, there are more than 100 stores in this shopping mall, and about 70,000 cultural heritages can be found, including ceramics, ancient books, paintings, wooden elements, folklore, stone objects, and other crafts. Antiques, old props, and unexpected luxury goods can be found. However, there are cases in which conflicts or disputes arise over the authenticity of ancient art. Therefore, on June 5, the Free Appraisal Event will be held to find out the value of relics. Appraisal committee members who appeared in the famous television program Genuine Luxury Goods will evaluate items. “As it is the first exhibition to be held at a time when the name is changed from cultural properties, which had a strong character of goods,…

-

Auction Industry

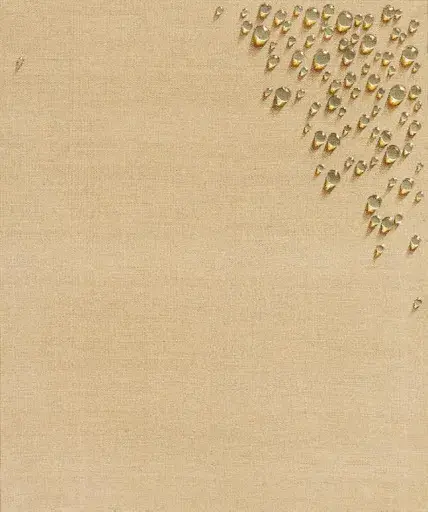

Auction Industry[옥션리뷰] 물방울 화가 김창열 국내외 경매에 잇단 출품… 최고가 경신할까?

‘물방울 작가’로 널리 알려진 김창열 화백의 작품이 한국 양대 경매사의 5월 경매를 비롯해 해외 경매에도 출품된다. 지난 2021년 1월 작고한 김 화백의 작품은 올해 3주기를 맞아 전시회를 비롯해 경매장에 속속 등장하고 있다. 지난 2022년 크리스티 홍콩 경매에서 물방울 그림 'CSH I'(182x227.5cm)이 985만 홍콩달러(약 14억 원·구매 수수료 포함)에 낙찰돼 작가 최고가를 경신한 바 있다. 이번 해외 경매를 통해 최고가를 경신할지도 관심사다. 김창열 화백, 물방울 PA81006(1980) (제공. 케이옥션) 케이옥션이 22일 서울 강남구 본사에서 여는 5월 경매에 김 화백의 작품 두 점이 출품된다. 1980년 제작한 '물방울 PA81006'이 추정가 1억6천만~2억2천만 원, 2001년작 '물방울 SA2001-001'은 추정가 5500만~1억 원에 나온다. 이밖에 총 72점, 74억 원 규모의 작품이 케이옥션 경매에 나왔다. 오는 28일 서울옥션 강남센터에서 열리는 서울옥션의 5월 경매에도 김 화백의 ‘물방울’(1980)이 출품된다. 추정가는 1억2천만~2억 원이다. 서울옥션은 이날 한국에서 가장 잘 팔리는 해외 작가인 쿠사마의 야요이의 흑백 ‘호박’(1991)도 추정가 5억8천만 원에 함께 내놓는다. 쿠사마의 이 작품은 색깔 있는 호박과 달리 모노톤을 띠고 세로로 길게 그려진 작품이다. 2000년대 이후 그려진 호박 작품들과 비교했을 때 점의 표현이 더욱 세밀하고 촘촘하다. 쿠사마 야요이, Pumpkin(1991) (제공. 서울옥션) 서울옥션은 이들 작품을 포함해 총 80점, 약 54억 원 규모 작품을 출품한다. 캔버스가 아닌 가로 5m가 넘는 6폭 종이에 그려진 이우환의 ‘무제’(1985)도 주목받는 작품으로 추정가 3억5천만~6억 원이다. 1986년 일본 도쿄에서 열린 작가의 병풍전에 출품됐던 작품이다. 이 밖에 새, 달, 점 등의 요소가 화폭에서 조화롭게 어우러지는 김환기의 '새와 달'을 비롯해 하종현, 심문섭 등 한국 미술사에 족적을 남긴 거장들의 작품이 나온다. 해외 작가 작품으로는 아야코 록카쿠의 'Untitled'(2022)이 새 주인을 찾는다. 작가의 첫 영국 개인전에 하이라이트 작품 중 하나로 전시된 바 있으며 추정가 3억5천만~5억 원이다. 이어서 28∼29일 홍콩 컨벤션센터에서 열리는 크리스티의 이브닝·데이 경매에 김 화백의 ‘물방울’(1975~1977)을 비롯해 한국 작품 17점이 나온다. 김 화백 작품은 28일 진행예정인 20세기 이브닝 경매에 선보이며 추정가 400만~600만 홍콩달러(약 이어서 28∼29일 홍콩 컨벤션센터에서 열리는 크리스티의 이브닝·데이 경매에 김 화백의 ‘물방울’(1975~1977)을 비롯해 한국 작품 17점이 나온다. 김 화백 작품은 28일 진행예정인 20세기 이브닝 경매에 선보이며 추정가 400만~600만 홍콩달러(약 7억~10억 원)이다. 2022년 작가 최고가 기록을 넘어설 수 있을지가 관전포인트다. 김창열 화백, 물방울(1975~1977) (출처. 크리스티) 같은 날, 한국 추상화 1세대 작가인 이성자의 '그림자 없는 산'(1962)도 추정가 400만∼600만 홍콩달러(약 7억∼10억원)에 선보인다. 미디어 아티스트 백남준의 '루트 66'(1993)은 150만∼250만 홍콩달러(약 2억6천만∼4억3천만 원), 21세기 미술 이브닝 경매에서는 이배의 '붓질 3-88'이 추정가 30만∼50만 홍콩달러(약 5200만∼8700만…

-

Auction Industry

Auction IndustryWater Drop Paintings by Kim Tschang-yeul, Yayoi Kusama Pumpkin to Sell at Auction This May

Works by artist Kim Tschang-yeul, widely known as "the water drop artist," will be exhibited at several upcoming auctions, including May sales by two major auction houses in Korea. Kim died in January of 2021. His works are appearing one after another at auction houses, including exhibitions, to mark the third anniversary of his death. At a 2022 Christie's Hong Kong auction, a water drop painting titled CSH 1 was sold for HKD 9.85 million (including purchase fees), setting a new record for the artist. Attention is focused on whether the upcoming sales will set a new record price. Kim Tschang-yeul’s Waterdrops PA81006 (1980). Image courtesy of K Auction. Two pieces of Kim's artwork were exhibited by K Auction at its headquarters in Seoul on May 22. They are Waterdrops PA81006, produced in 1980, and Waterdrops SA2001-001, produced in 2001. A total of 72 pieces, about USD 5.43 million, were also exhibited at the K Auction event. Kim's Water Drops (1980) will also be exhibited at Seoul Auction's May sale, held at Gangnam Center on May 28. The estimate ranges from $87,000 to $145,000. Seoul Auction will also unveil a black-and-white Pumpkin (1991) by Yayoi Kusama, one of Korea's best-selling foreign artists, at an estimated price of $426,000. Unlike other colorful pumpkin paintings, Kusama's monochrome piece is painted vertically. Compared to other pumpkin paintings since the 2000s, the available work has a tighter dot representation. Yayoi Kusama’s Pumpkin (1991). Image courtesy of Seoul Auction. Seoul Auction will display a total of 80 artworks, worth about $3.96 million, including these artworks. Lee Ufan's Untitled (1985), which was painted on a six-page paper measuring more than five meters wide, is also drawing attention, with an estimated price of $254,000 to $436,000. The artwork was exhibited at the artist's folding screen exhibition in Tokyo in 1986. In addition, the sale will present Kim Whan-ki's Bird and Moon (estimated at $254,000 to $400,000), which harmoniously blends a bird, moon, and dots on the canvas, as well as masterpieces by the likes of Ha Chonghyun and Shim Moonseup that have left traces of Korean art…

-

Auction Industry

Auction Industry[미술시장] 숨죽인 1분기 미술 경매시장… 세계 3대 경매사 판매 18.3% 하락

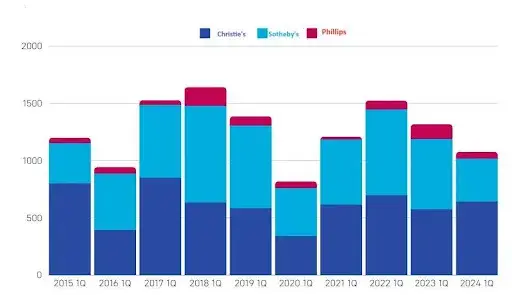

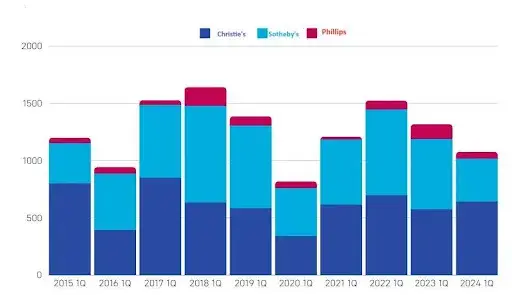

2024년 1분기 글로벌 3대 경매사(크리스티, 소더비, 필립스) 매출은 지난해 같은 기간(13억 2천만 달러)보다 18.3% 하락한 10억 8천만 달러를 기록했다. 이는 2022년 대비해서도 29.4% 줄어든 수치로 뉴욕과 런던의 매출 하락이 영향을 미친 것으로 분석됐다. 다만 크리스티는 파리 매출의 큰 폭 증가에 힘입어 1분기 매출이 지난해 같은 기간보다 11.2% 늘어났다. 2015-24년 세계 3대 경매사 낙찰 총액(단위: 100만 달러) (제공. 한국미술품감정연구센터) 한국미술품감정연구센터(이하 센터)는 ‘2024년 1분기 미술시장 분석 보고서’를 통해 글로벌 경매시장은 지난해 같은 기간보다 경매 횟수와 작품 수량이 감소한 가운데 온라인을 통한 거래 방식이 안정적으로 정착되고 있다고 밝혔다. 올해 1분기 경매횟수는 151회로 2023년의 166회보다 줄었고, 판매된 총 로트 수도 1만7905점으로 2023년의 1만9846점에서 감소했다. 팬데믹이 누그러졌음에도 오프라인 경매(16.6% 감소) 감소가 두드러졌다. 평균 경매 가격은 2017년 이래 가장 낮은 수준인 6만113달러로 지난해 6만6350달러보다 떨어졌다. 다만 3대 경매사의 온라인 전용 매출은 1분기에 약 1억4200만 달러로 지난해 같은 기간의 약 1억4700만 달러보다 3.4% 감소해 큰 차이는 없었다. 특히 온라인 전용 채널을 통해 판매된 작품 수는 1분기 경매 전체의 59.8%로 지난해 같은 기간의 56.6%보다 높아졌다. 총 경매 판매액에서는 온라인이 13.2%(지난해 11.2%)를 기록했다. 센터는 “온라인 거래 방식이 안정적으로 정착되고 있음을 확인할 수 있다”고 평가했다. 지역별로는 뉴욕, 런던의 판매가 주춤했으나, 파리 매출(1억 1700만 달러)이 눈에 띄었다. 크리스티가 3월에 열었던 바비에-뮐러 컬렉션(Barbier-Mueller Collection) 덕분이다. 이 컬렉션 경매는 파리에서 1분기에 달성한 전체 매출 가운데 62.3%(7300만 달러)로 독보적이었다. 반면 뉴욕과 런던은 지난해 같은 기간보다 각각 23.5%, 16.7% 떨어졌다. 센터는 “수준 높은 컬렉션이 시장으로 유입될 때 전체 매출에서 절대적 비중을 차지하는 규모를 달성할 수 있는 것은 미술시장 매출 구조의 가장 큰 특성”이라고 설명했다. 소더비 경매 장면 (출처. 소더비 홈페이지) 분야별로 보면, 전후 및 현대 미술 매출이 전년 대비 약 48.3% 급락했고, 인상파 및 현대미술도 약 8.8% 떨어지면서 이들이 경매 매출의 전반적인 감소를 주도했다. 판화(프린트 및 에디션 포함)는 지난해의 매출 급등세를 잇지 못하고 지난해 같은 기간보다 8.9% 하락했다. 경매 출품 작품 수가 9.9% 늘어났음에도 매출이 꺾인 것은 판화 작품 가격이 더 낮은 수준에서 거래 됐음을 의미한다. 센터는 “새롭게 등장한 컬렉터 층이 선호하는 부담없이 가벼운 가격대 작품도 전체적인 경기로 인해 주춤하는 세태를 반영했다”고 전했다. 이와 함께 1분기 한국 경매시장은 2023년 같은 기간보다 약간 회복되는 기미를 보였다. 그러나 1차 시장, 유통시장은 거래 움직임이 거의 없었다고 할 정도로 위축된 상황이다. 한국의 주요 경매사인 케이옥션, 서울옥션, 마이아트옥션은 총 7회…

-

Auction Industry

Auction IndustrySales at World’s Top Three Auction Houses Fell 18.3% in 2024’s First Quarter

In 2024’s first quarter, sales at the three major global auction houses (Christie's, Sotheby's, and Phillips) fell 18.3% from the same period last year to USD 1.08 billion. The figure is also down 29.4% compared to 2022, a decrease attributed to falling sales in New York and London. However, Christie's sales increased 11.2% in the first quarter compared to the same period last year thanks to a sharp increase in Paris sales. Total bid amount of the top three global auctioneers in 2015-24 (unit: USD 1 million). Image courtesy of KAAAI. According to the "Art Market Report 1Q 2024" released by Korea Art Authentication & Appraisal Inc. (KAAAI), the global auction market is steadily establishing online trading methods amid a decrease in the number of auctions and the number of works compared to the same period last year. The number of auctions was 151 in 2024’s first quarter, down from 166 in 2023, and the total number of lots sold was 17,905, down from 19,846 in 2023. Despite the easing of the pandemic, the decline in offline auctions (down 16.6 percent) was noticeable. The average item price at auction was $60,113, the lowest level since 2017, down from $66,350 last year. The online sales of the three major auction houses amounted to about $142 million in 2024’s first quarter, down 3.4% from about $147 million in the same period last year, making no significant difference. In particular, the number of artworks sold through online-only channels accounted for 59.8% of all auctions in the first quarter, up from 56.6% in the same period last year. In terms of total auction sales, online sales accounted for 13.2% (compared to 11.2% last year). "We can confirm that online transaction methods are stably established," KAAAI said. By region, sales in New York and London fell, but Paris saw a notable increase in sales ($117 million). This was attributed to the Barbier-Mueller Collection, which Christie's held in Paris in March. The auction of the collection represented 62.3% ($73 million) of the total sales achieved in the first quarter of the year in Paris. On the other…

-

Auction Industry

Auction Industry[미술축제] 9월 광주, 부산, 서울을 미술로 물들이는 ‘대한민국 미술축제’ 개최

전국의 대규모 미술 축제가 한 울타리에 모인다. 이에 올 가을, ‘대한민국 미술축제’라는 이름으로 미술로 물든 한국을 만난다. 미술에 관해 높아지는 관심을 확장하는 한편 K-아트를 세계 시장에 널리 알리는 계기가 될 것으로 보인다. 오는 9월 광주·부산·서울을 잇는 '대한민국 미술축제' 공동선언 현장. (제공. 문화체육관광부) 오는 9월 광주, 부산, 서울에서 열리는 다양한 미술 행사를 통합한 ‘대한민국 미술축제’(2024 Korea Art Festival)가 열린다. 이에 문화체육관광부의 미술주간(9월 1~11일), 광주비엔날레(9월 7~12월 1일), 부산비엔날레(8월 17~10월 20일), 국제 아트페어인 ‘키아프 서울’과 ‘프리즈 서울’(9월 4~8일), 서울아트위크(9월 2~8일) 등이 함께한다. 이를 위해 문체부, 광주시, 부산시, 서울시 등이 대한민국 미술축제를 위한 긴밀한 협력을 비롯해 각종 전시와 행사 내용, 일정을 연계해 해당 축제를 한국 대표 미술 행사로 추진하겠다는 내용을 담은 공동선언문을 발표했다. 이들 외에도 한국화랑협회, 프리즈 서울, 예술경영지원센터, 한국관광공사 등도 함께 참여한다. 지난해까지는 미술주간을 통해 지자체와 공공∙민간 미술 행사에 대한 통합 홍보 및 전시 할인 혜택 등에 머물렀다면 올해는 전국 미술 행사를 유기적으로 연계하는 데 초점을 둔다. 이 기간에 지자체가 주도하는 행사 외에도 국·공·사립 미술관과 갤러리의 수준 높은 기획전시도 다수 열린다. 내국인뿐만 아니라 한국을 찾은 해외 미술 애호가들의 눈높이를 충족하겠다는 심산이다. 대표적으로 국립현대미술관 서울은 ‘접속하는 몸: 아시아 여성 미술가전’(9월 4일)과 야간 개장을 통해 다양한 참여형 행사와 미술인 교류 행사를 진행한다. 해외 미술시장을 향한 K-아트 홍보도 적극 이뤄진다. 이를 위해 해외 미술관 관계자와 언론인 등을 초청해 한국 미술을 알리는 인바운드 프로모션을 운영한다. 또 키아프 서울과 프리즈 서울, 예술경영지원센터는 코엑스 스튜디오 159에서 ‘한국미술 담론 콘퍼런스’(9월 5~7일)를 개최한다. 유인촌 문체부 장관은 “관계기관과 해외 지사 등을 총동원해 우리 미술을 세계 시장에 홍보할 계획”이라며 “젊은 작가부터 원로들까지 국내는 물론 해외에서도 인정받을 수 있는 시장을 만들어보겠다”고 말했다. 지난해 열린 광주비엔날레 전시 현장. Ⓒ옥션데일리 미술 축제의 성공적 개최와 운영을 위해 관람, 관광과 교통 편의도 제공된다. 광주비엔날레와 부산비엔날레를 잇는 통합입장권을 정액 대비 30% 할인한 2만3800원에 판매한다. 해당 입장권 소지자는 예술의전당, 리움 등 주요 미술관 전시 할인과 무료입장 혜택을 받을 수 있다. 한국철도공사는 비엔날레 입장권 연계 고속철도(KTX) 관광상품을 판매한다. 한국관광공사는 지역별 미술 시설을 지도로 그린 관광 코스를 안내하고, 도보 미술여행 상품과 미술축제를 연계한 관광상품 판매도 추진한다. 문체부는 홈페이지와 사회관계망서비스(SNS), 정부·지자체 보유 옥외전광판, 공항·역사 등을 통해서도 통합 홍보에 나선다. 재외한국문화원, 한국관광공사 해외지사 등을 활용해 해외에도 정보를 제공하는 등 적극 홍보할 방침이다. 현재 해외에서 각광받고 있는 K-컬처(콘텐츠)의 뿌리인 순수예술을 국내외에 좀더 알리고 관심을 끌기…

-

Auction Industry

Auction Industry2024 Korea Art Festival Will Be Held This September, Connecting Gwangju, Busan, and Seoul

A large-scale art festival in Korea will be held this fall. The 2024 Korea Art Festival is expected to serve as an opportunity to expand the growing interest in art and to promote K-art to the global market. The 2024 Korea Art Festival, which integrates various art events in Gwangju, Busan, and Seoul, will be held in September. Accordingly, the Art Week (September 1 - 11, 2024) of the Ministries of Culture, Sports and Tourism (MCST) links together the Gwangju Biennale (September 7 - December 1, 2024), the Busan Biennale (August 17 - October 20, 2024), the global art fairs Frieze Seoul and Kiaf Seoul (September 4 - 8, 2024), and Seoul Art Week (September 2 - 8, 2024). To this end, MCST, Gwangju City, Busan Metropolitan City, and Seoul Metropolitan Government announced a joint declaration that they will promote the festival as a representative Korean art event by linking various exhibitions, events, and schedules, including close cooperation. In addition to them, the Galleries Association of Korea, Frieze Seoul, Korea Arts Management Service (KAMS), and Korea Tourism Organization (KTO) will participate. Joint Declaration of 2024 Korea Art Festival Connecting Gwangju, Busan, and Seoul. Image courtesy of MCST. Until last year, Art Week was limited to integrated promotions and exhibition discounts for local governments and public and private art events. This year, the focus is on organically linking art events across the country. During the 2024 Korea Art Festival, a number of high-quality exhibitions of national, public, and private museums and galleries will also be held in addition to events led by local governments. The goal is to meet the standards of not only Koreans but also foreign art lovers visiting Korea. Representatively, the National Museum of Modern and Contemporary Art (MMCA), Seoul, will hold various participatory events and artist exchange events, including "Connecting Body: Asian Women's Artists" (opening on September 4) and opening at night. K-art will also be actively promoted to overseas art markets. To this end, Kiaf Seoul, Frieze Seoul, and KAMS will co-host the "Korean Art Discussion Conference" (September 5 - 7) at COEX Studio 159. "We will mobilize all…

-

Auction Industry

Auction Industry[아트페어] 미술시장의 봄날 올까?… 다양한 미술 장터가 열린다!

봄을 맞아 국내 아트페어들이 줄줄이 기지개를 켠다. 이를 통해 올해 국내 미술시장 판도와 경향성을 가늠해 보는 한편 현재 침체기에서 반등 여부를 판단하는 계기가 될 것으로 보인다. 2024 화랑미술제 전시 전경 (제공. 화랑미술제 운영위원회) 한국에서 가장 오래된 화랑미술제는 올해 42회를 맞아 지난 3일부터 156개 갤러리가 1만여점 작품을 선보이며 닷새동안 진행했다. 관람객은 5만 8천여 명이 다녀갔다. 행사를 주최한 한국화랑협회는 매출액을 공개하지 않았다. 참여 갤러리들은 MZ세대 컬렉터들의 취향에 맞춰 신진 아티스트들에게 무게를 줬다. 이에 200만~500만 원대 신진 작가들의 작품이 판매 호조를 보인 것으로 알려졌다. 특히 39세 이하 작가들 작품을 모은 특별전 ‘줌인’이 관심을 끌었다. 570여 명 작가가 응모했고, 10명의 작품이 선발돼 전시된 가운데, 관람객 투표와 전문가 심사를 통해 3인에게 상을 줬다. 황달성 한국화랑협회 회장은 “기존 컬렉터들에게는 또 다른 취향 발견의 기회가, 신규 컬렉터들에게는 미술 시장 입문의 기회가 됐다”고 말했다. 뒤를 이어 2024브리즈 아트페어가 18일 예술의전당 한가람미술관에서 개막했고, 신생 아트페어인 ‘아트오앤오’가 19일 SETEC에서 막을 열었다. 이들 모두 새롭고 젊은 아티스트들 발굴과 소개에 방점을 찍고 있다. 경기 침체로 고가의 대형 작품에 대한 수요가 줄어든 대신 신진 아티스트 작품과 MZ컬렉터들의 취향이 맞아 떨어진 결과로 보인다. 이를 통해 침체된 시장 분위기를 타개할 수 있을지도 주목받고 있다. 관람객들이 지난해 열린 브리즈 아트페어를 둘러보고 있는 전경. (제공. 브리즈 아트페어) 올해 11회를 맞이한 브리즈 아트페어(이하 브리즈)는 28일까지 열린다. 올해 96명 아티스트가 참여했고, 10만 원부터 2000만 원 사이 다양한 가격대 작품 1000여 점이 선을 보였다. 아티스트가 관람객들에게 직접 작품을 소개하는 정체성을 가진 브리즈는 신진 아티스트의 메카로 자리잡았다. 2012년부터 공개 모집을 통해 아트페어 참여 아티스트를 선발하고 있으며 올해 928명이 신청해 역대 최다 아티스트들이 지원했다. 특히 처음으로 글로벌 트랙을 열어 해외 신진 아티스트들의 신청을 받았으며 미국, 독일, 중국, 대만, 러시아에서 5명의 아티스트들이 한국을 방문해 관람객들과 만났다. 정지연 페어디렉터는 “매년 구매 고객의 25%가 미술품을 처음 구매하는 사람일 정도로 브리즈는 신진 작가와 초보 컬렉터를 연결하는 새로운 시장을 만들고 있다”며 “올해는 처음으로 글로벌 트랙을 열었는데 다양한 나라의 예술가들이 지원했고, K-컬쳐와 한국 미술시장에 대한 관심과 기대를 확인할 수 있었다”고 말했다. 기존 아트페어와 차별화를 선언한 아트오앤오(이하 오앤오)는 올해 처음 열렸다. MZ컬렉터인 33세 노재명 대표가 선보인 오앤오는 ‘원 앤 온리(One and Only)’의 약자로, 'Young and Fresh but Classy'라는 방향성을 갖고 있다. 올해 첫 행사에 15개국 40여개 갤러리가 참여했다. 국내에 처음 소개되는 갤러리들이 다수로 신진 작가들이 대거 참여한 한편 블루칩 작가와 대형…

-

Auction Industry

Auction IndustrySpring 2024 Korean Art Fairs, From Breeze to ART OnO

Korean art fairs are stretching out one after another this spring. This will serve as an opportunity to gauge the landscape and trend of the domestic art market this year and to judge whether the Korean art market will rebound from the current downturn. Marking its 42nd anniversary this year, Galleries Art Fair was held for five days from April 3, 2024, with 156 galleries displaying more than 10,000 pieces. More than 58,000 visitors attended. The Galleries Association of Korea, which hosted the event, did not disclose the sales figures. Participating galleries gave weight to emerging artists to suit the tastes of Millennial-Generation Z (MZ) generation collectors. Accordingly, works by new artists reportedly showed strong sales. Galleries Art Fair 2024 Exhibition View. Image courtesy of Galleries Art Fair Operating Committee. In particular, a special exhibition called "Zoomin," which collected works by artists under age 39, drew attention. Some 570 artists applied and ten selected works were on display. The awards were given to three artists through audience voting and expert screening. "It was another opportunity for existing collectors to discover tastes and for new collectors to enter the art market," said Hwang Dalseong, president of the Galleries Association of Korea. Following this, the 2024 Breeze Art Fair opened at the Hangaram Art Museum in Seoul Arts Center on April 18, and the new art fair called ART OnO opened at SETEC on April 19. All of them are focusing on discovering and introducing new and young artists. It seems that this has resulted in a decrease in demand for large-scale expensive artworks due to the economic downturn, while emerging artists' works and MZ collectors' tastes have matched. Attention is also focusing on whether this will help overcome the sluggish market atmosphere. Celebrating its 11th anniversary this year, the Breeze Art Fair (hereinafter referred to as Breeze) will run until May 28. A total of 96 artists participated in the event this year, and more than 1,000 works with various prices ranging from about $73 to $14,000 were showcased. With its brand identity of artists introducing their artworks directly to an audience,…

-

Auction Industry

Auction Industry[옥션리뷰] 이중섭 ‘시인 구상의 가족’, 70년 만에 첫 경매

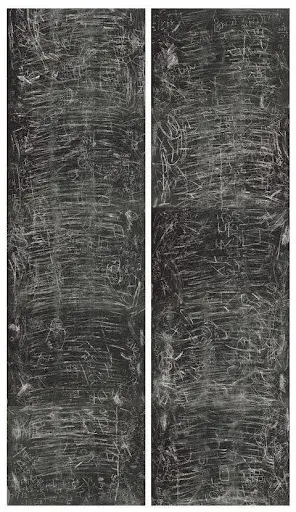

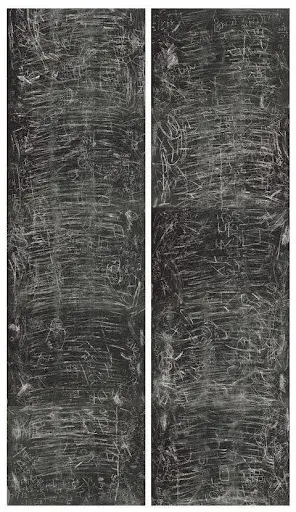

양대 경매사의 4월 경매는 그동안 경매에서 보기 힘들었던 작품들을 선보인다. 실험미술 작가인 이건용의 퍼포먼스 결과물을 비롯해 근대화가 이중섭의 작품이 70년 만에 경매에 오른다. 앙리 마티스의 작품도 국내 경매에는 처음 선보인다. 이건용 ’달팽이 걸음’ (제공. 서울옥션) 서울옥션은 23일 서울 강남센터에서 총 113건을 출품한다. 가장 눈에 띄는 작품은 실험미술 작가인 이건용의 대표 퍼포먼스 '달팽이 걸음'의 결과물이 처음 경매에 나온다. '달팽이 걸음'은 쪼그려 앉은 채 분필로 선을 그리는 동시에 맨발로 그 선의 일부를 지우며 나아가는 퍼포먼스다. 경매에 나온 작품은 2007년 인천 부평역사박물관에서 열린 '한국-터키 수교 50주년 기념전'에서 진행한 퍼포먼스 결과물이다. 10점이 한 세트로, 추정가는 2억∼3억 원이다. 단색화 작가 하종현의 '접합' 연작과 박서보의 '묘법' 연작을 비롯해 문신, 이대원, 남관 등 근대미술작가의 1940∼50년대 회화 작업, 극사실주의 화가 고영훈의 대형 설치작업 '위'(We) 등도 경매에 나온다. 고미술품 분야에서는 사료 가치가 풍부한 고지도와 희귀 고문서가 출품된다. 특히 시작가 3천만 원에 나온 ‘신정만국전도’는 1855년 일본 정부가 제작한 지도로 동해를 일본해가 아닌 ‘조선해'(朝鮮海)로 표기했다. 지난해 KBS 'TV쇼 진품명품'에 소개돼 감정가 5천만 원으로 평가받았다. 이밖에 '모란도'(추정가 4억∼6억 원) '곽분양행락도'(3억∼5억 원), '요지연도'(4억5천∼8억 원) 등 채색 병풍화도 경매된다. 출품작은 서울옥션 강남센터에서 무료로 볼 수 있다. 이중섭 ’시인 구상의 가족’ (제공. 케이옥션) 뒤를 이어 24일에는 케이옥션이 서울 강남구 본사에서 70년 만에 경매에 출품된 이중섭 작품을 비롯해 김환기의 뉴욕시대 점화 등 총 130점, 약 148억 원어치 경매를 선보인다. 가장 눈에 띄는 작품은 박수근과 함께 한국 근대서양화의 양대 거목으로 꼽히는 이중섭의 '시인 구상의 가족'이다. 슬픈 사연을 품은 이 작품은 1955년 이중섭이 시인 구상에게 줬다. 당시 이중섭은 서울과 대구에서 연 개인전이 크게 흥행한 덕분에 한국전쟁으로 헤어져 일본에 있는 가족과 재회할 희망에 부풀었다. 그러나 흥행 성공에도 불구하고 작품 판매 대금을 받지 못한 탓에 일본으로 갈 수 없었다. 낙담한 이중섭은 오랜 친구인 구상의 집을 찾았다. 구상이 아들과 자전거를 타는 모습을 보자 눈물이 났다. 자전거를 사주겠다고 약속한 자신의 아들 생각이 난 까닭이다. 그리고 행복한 구상 가족의 모습을 그리면서 자신의 모습도 오른쪽에 덩그러니 넣었다. 이중섭은 구상에게 “가족 사진”이라며 그림을 건넸다. 그림의 왼쪽 끝에는 구상 가족을 등지고 선 소녀가 나오는데, 구상의 집에서 잠시 머물던 소설가 최태응의 딸이다. 행복해 보이는 가족의 양쪽에 어쩌면 동병상련을 느낄 법한 이중섭과 소녀가 배치돼 슬픔과 그리움도 함께 불러 일으킨다. 케이옥션은 “이중섭의 손이 원근법을 무시하고 구상 아들의 손과 닿아 있다”며 “이중섭의 다른 작품에서도 길게 늘어난 팔이 가족, 동물, 타인들과 연결되는데, 이는…

-

Auction Industry

Auction IndustryApril Auctions in Korea Feature Rare Works by Lee Kun-yong, Lee Joong-seop, and Kim Whan-ki

This month, auctions at Korea's two largest auction houses will feature rare works that have recently been difficult to see in the market. Lee Kun-yong's Snail Walk. Image courtesy of Seoul Auction. Seoul Auction will display a total of 113 items at an auction to be held at Gangnam Center in Seoul on April 23, 2024. The most notable artwork is the result of experimental artist Lee Kun-yong's representative performance, titled Snail Walk. This artwork will be put up for auction for the first time. Snail Walk is a performance where an artist squats down and draws lines with chalk while removing some of those lines with his bare feet. The artwork at auction is the result of the performance at the 50th-anniversary exhibition of diplomatic ties between Korea and Turkey held at the Bupyeong Museum of History in Incheon in 2007. A set of ten items costs an estimated USD 150,220 to $225,300. Works from monochromatic artist Ha Chong-Hyun's Conjunction series and Park Seo-bo's Écriture series will be available, as well as items by modern artists such as Moon Shin, Lee Dai Won, and Nam Kwan. Hyperrealist painter Ko Young Hoon's large-scale installation work titled We will also be auctioned. Ancient maps and rare ancient documents with rich historical value will be exhibited in the ancient art field. Notably, Map, which started at $22,600, was created by the Japanese government in 1855 and marked the East Sea with the Sea of Joseon, not the Sea of Japan. Last year, Map was introduced to a KBS program that determines whether ancient art is genuine or not and was appraised at around $36,000. These entries can be viewed free of charge at the Seoul Auction Gangnam Center. Lee Joong-seop's Family of Poet Ku Sang. Image courtesy of K Auction. Following this, on April 24, 2024, K Auction will showcase a total of 130 items together worth approximately $10.62 million at its headquarters in Gangnam-gu, Seoul, including Lee Joong-seop's artwork, which will be auctioned for the first time in 70 years and Kim Whan-ki's dot painting of the New York era. The…

-

Auction Industry

Auction Industry[옥션리뷰] 국내외 현대미술 작가들의 향연이 펼치는 3월 경매

현대미술을 대표하는 국내외 작가들의 작품이 케이옥션과 서울옥션 3월 경매에 나온다. 프랑스 추상화가 베르나르 프리츠 'Gawk.' (제공. 케이옥션) 케이옥션은 20일 서울 강남구 본사에서 98점, 약 75억 원어치 작품을 경매에 부친다. 이번 경매에는 프랑스 대표 추상화가 베르나르 프리츠의 작품 'Gawk'(추정가 2억~3억 원)이 가장 눈에 띈다. 국내 경매에서는 거의 보기 힘들었던 그의 작품으로 절제된 그리드 패턴과 함께 여러 층으로 쌓아 올린 색의 향연이 돋보인다. 우고 론디노네의 ‘Einundzwanzigsterdezemberzweitausendundeinundzwanzig’(1억8천만~2억5천만 원)은 시간 흐름에 따른 색채와 빛의 변화를 아름답게 담아냈다. 데미안 허스트의 ‘Psalm 115: Non Nobis, Domine’(2억5천만~4억 원)도 만날 수 있다. 국내 작가로는 김환기, 김창열, 이우환 등 단색화 거장들의 작품이 새 주인을 찾는다. 김환기가 뉴욕시절, 신문지에 유채로 그린 작품 두 점도 경매에 오른다. 점화가 완성되기까지 과정을 유추해 볼 수 있으며, 점화가 탄생하는데 밑거름이 된 작품이다. '물방울 화가' 김창열의 작품은 ‘물방울 SA0001’(1억8천만~3억 원) 등 여섯 점이 출품된다. 이우환의 작품은 ‘조응’(3억5천만~5억5천만 원), ‘바람과 함께’(1억1천만~2억2천만 원), ‘Dialogue’(9천만~2억 원) 등 총 다섯 점이 나온다. 이밖에 한국 추상미술 대표작가인 이승조의 ‘핵 87-09’(2억1천만~4억5천만 원)을 비롯해 추상 표현주의 선구자 최욱경의 ‘풍경’(8500만~1억5천만 원)도 선보인다. 실험미술의 대가 이강소의 ‘From an Island-07240’(8천만~2억5천만 원)과 ‘허(虛)-15016’(6500만~1억2천만 원)도 경매에 오른다. 김환기의 전면점화 작품 ‘3-Ⅴ-71 #203’. (제공. 서울옥션) 뒤를 이어 29일에는 서울옥션이 강남센터에서 총 85점, 약 180억 원 규모의 작품들을 내놓는다. 케이옥션과 마찬가지로 김환기, 김창열의 작품도 나온다. 김환기의 전면점화 ‘3-Ⅴ-71 #203’(50억~80억 원)는 네 가지 색깔이 띠 모양으로 그려진 대작으로 각 띠마다 다른 점 찍기 기법이 사용돼 희소성이 높다. 그의 다른 작품 ‘새와 달’(6억~10억 원)은 새, 달, 점 등이 조화롭게 어우러진다. 영롱하고 맑은 느낌을 준다고 평가받는 김창열의 1970년대 작품 두 점을 비롯해 총 네 점의 ‘물방울’이 경매에 오른다. 신진 작가들 작품도 눈길을 끈다. 강서경, 전광영, 정영주, 김선우 등 최근 한국 미술계에서 주목받는 작가들의 작품과 함께 세계적으로 알려진 K-Pop 가수 지드래곤(본명 권지용)의 ‘Youth is Flower’도 출품된다. 한국 미술계 큰손으로 알려진 지드래곤은 2019년 미국 유명 미술 전문지 아트뉴스가 선정한 ‘주목할 만한 컬렉터 50인’에 들기도 했다. 소장품이 아닌 그가 직접 그린 작품이 경매에 나온 것은 처음이다. 해외 작품군에서는 팝아트 거장 앤디 워홀의 희소성 높은 판화 10점 세트 ‘Campbell's Soup II (Set of 10)’, 작가를 상징하는 노란색 호박이 그려진 쿠사마 야요이의 ‘Pumpkin’, 지난해 타계한 페르난도 보테로의 ‘Men Drinking’, 브라이언 캘빈의 ‘Almost Gone’ 등이 새 주인을 찾는다. 이번 경매는 아트바젤 홍콩 기간에 맞춰 홍콩 현지 프리뷰를 진행한다. 경매에 앞서 여는 프리뷰 전시는 경매 당일인 29일까지 강남센터에서 관람할 수 있다. 다만 일부 작품들은 홍콩 프리뷰 전시를 위해 16일까지만 관람이 가능하다.

-

Auction Industry

Auction IndustryContemporary Masterpieces at Auction in Korea This March

Works by domestic and foreign artists representing contemporary art will be auctioned in March at K Auction and Seoul Auction, the two largest auction houses in Korea. French abstract painter Bernard Frize's Gawk. Image courtesy of K Auction. K Auction will present 98 pieces, worth about $5.7 million, at its headquarters in Gangnam-gu, Seoul, on March 20. The most notable lot is French abstract painter Bernard Frize's Gawk (estimated USD 150,000 - $230,000). His work, which is rarely seen at domestic auctions, stands out with a restrained grid pattern and a feast of colors stacked in layers. Ugo Rondinone's Einundzwanzigsterdezemberzweitausendeinundzwanzig (estimate: $140,000 - $190,000) beautifully captures the changes of colors and lights over time. Bidders can also consider Damien Hirst's Psalm 115: Non Novis, Domine (estimate: $190,000 - $300,000). As for Korean artists, contemporary masterpieces by monochromatic masters such as Kim Whan-ki, Kim Tschang-yeul, and Lee Ufan are looking for a new owner. Two works that Kim Whan-ki painted in oil on newspapers during his New York era will be auctioned. These works are meaningful in that they can infer the process until dot painting was completed; they served as the foundation for the birth of dot painting. Six works by Water Drops artist Kim Tschang-yeul will be exhibited, including Waterdrops SA0001 (estimate: $140,000 - $230,000). There will be a total of five works by Lee Ufan, including Correspondence (estimate: $260,000 - $410,000), With Winds (estimate: $83,000 - $170,000), and Dialogue (estimate: $68,000 - $150,000). In addition, Nucleus 87-09 (estimate: $160,000 - $340,000) by Lee Seung-jio, a leading Korean abstract artist, and Scape (estimate: $64,000 - $110,000) by Choi Wook-kyung, a pioneer of Abstract Expressionism, will be exhibited. Two works by Lee Kangso, a master of experimental art, will also be auctioned off: From an Island-07240 (estimate: $60,000 - $190,000) and Emptiness-15016 (estimate: $49,000 - $90,000). Kim Whan-ki's 3-V-71 #203. Image courtesy of Seoul Auction. Following this, on March 29, Seoul Auction will offer a total of 85 works, together worth about $13,534,000, at the Gangnam Center. Just like K Auction, there are works by Kim Whan-ki and Kim Tschang-yeul. Kim…

-

Auction Industry

Auction IndustryAhn Jung-geun Handwriting Piece Returns to Korea After Selling for $1 Million

Approximately USD 1 million dollars was the winning bid for an undisclosed handwriting piece by Korean independence activist Ahn Jung-geun at a recent auction in Seoul. The bidding started at about $380,000. The auction price went up as bidders raised the asking price. When the auction price exceeded the original estimate and reached about $1 million, there was only one paddle left. Finally, it was sold for the second-highest price among Ahn's handwriting, following one that recorded the record price (about $1.46 million) in December of last year. Undisclosed handwriting of independence activist Ahn Jung-geun returned to Korea through an auction. Image courtesy of Seoul Auction. With this recent sale, the handwriting piece has returned to Korea after 114 years. Ahn Jung-geun wrote the piece in the Rushun Prison after he assassinated Ito Hirobumi, a key figure in Japanese imperialism, in 1910. He left more than 200 pieces in prison at the time. The newly auctioned handwriting has the meaning of "a person's mind changes from morning to evening, but the color of the mountain remains the same as before." It can be interpreted as comparing his feelings for independence to the color of mountains. Extraordinarily, the new owner of the painting was also disclosed. Hanmi Semiconductor, a Korean semiconductor company, won the bid. The company was founded by the late chairman Kwak Roh-kwon, a descendant of Korean independence activist Kwak Han-so. "Hanmi Semiconductor joined the effort to recover the handwriting of Ahn to support Kwak's will, who passed away in December last year as a descendant of an independence activist," Seoul Auction said. As a result, Ahn's handwriting returned to Korea. Another handwriting piece returned after an auction in December of last year, thanks to Kim Woong-ki, chairman of the Global Seah Group. He purchased that handwriting piece for about $1.46 million. Both works were reportedly owned by the Japanese before they were auctioned off in Korea. Japanese officials, who came to respect Ahn for his steadfast courage in the Rushun Prison, asked him for his handwriting and handed it over to his descendants, so they stayed in Japan.…